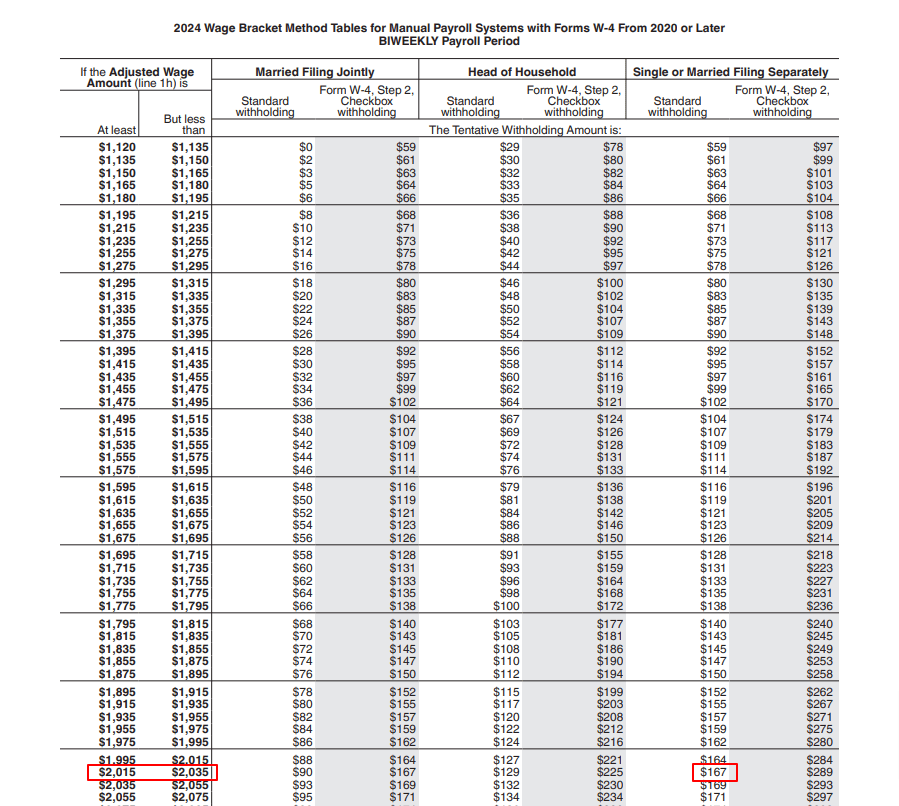

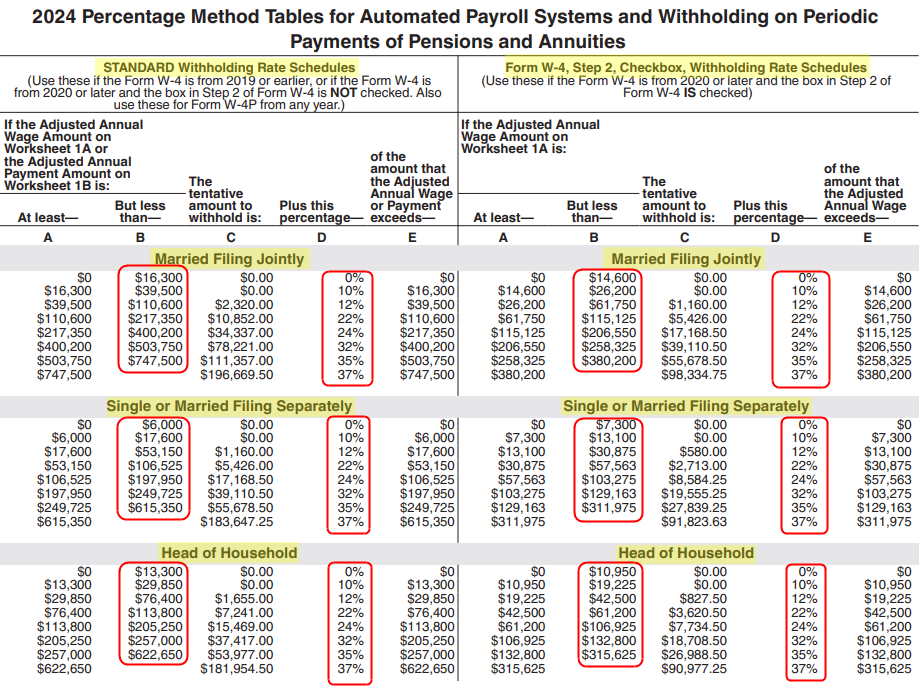

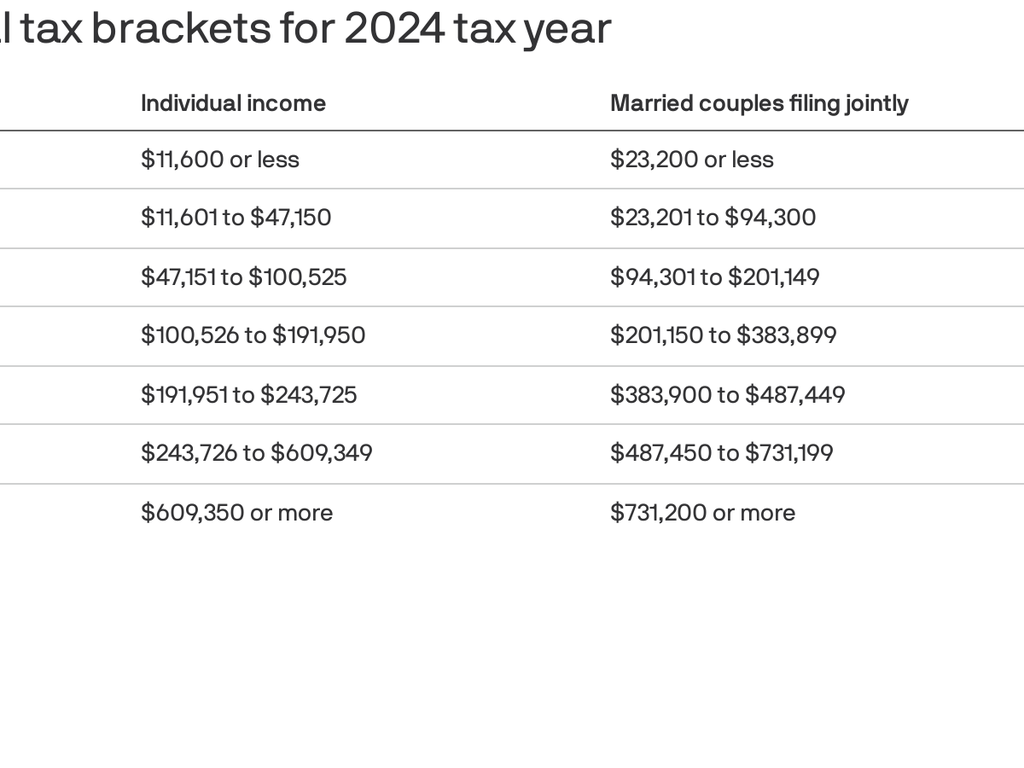

Standard Withholding Table 2024 – Tax brackets are the government’s way of ensuring that taxpayers who earn more money pay more in taxes. Each bracket consists of a tax rate that’s applied to taxable income within a specific range. . The big picture: New IRS tax brackets and increased standard deductions go into Zoom in: The IRS also changed 2024 tax withholding tables, which determine how much money employers should .

Standard Withholding Table 2024

Source : www.forbes.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comPowerChurch Software Church Management Software for Today’s

Source : www.powerchurch.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comIRS Tax Brackets 2024, Federal Income Tax Tables, Inflation Adjustment

Source : www.nalandaopenuniversity.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com2024 tax brackets: IRS inflation adjustments to boost paychecks

Source : www.axios.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comProjected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.comStandard Withholding Table 2024 Your First Look At 2024 Tax Rates: Projected Brackets, Standard : Is Box 2(c) on the W-4 form Checked?: If Box 2(c) is NOT checked, then the federal withholding is calculated from the STANDARD threshhold tables. If it IS checked, then the federal withholding is . “About Form W-4 V, Voluntary Withholding Request.” Internal Revenue Service. “Earned Income and Earned Income Tax Credit (EITC) Tables “IRS Issues Standard Mileage Rates for 2024 .

]]>